Distressed M&A (Mergers and Acquisitions) refers to transactions involving companies that are experiencing financial or operational distress. These companies may be undergoing legal proceedings, significantly underperforming, or nearing insolvency.

Distressed M&A: How to Separate the Wheat from the Chaff.

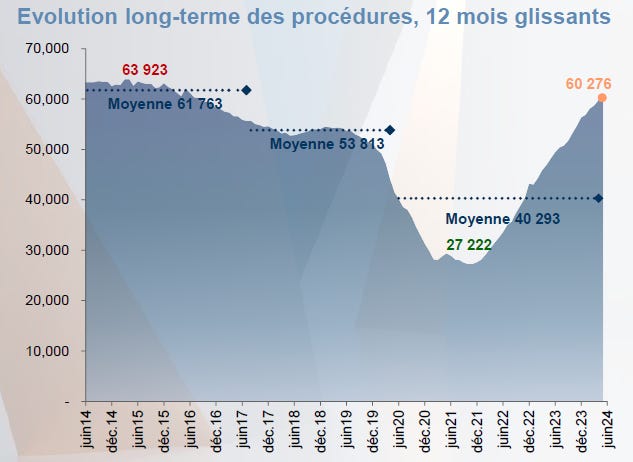

In a context where we are seeing an increase in proceedings in France (as shown in the figure below), we found it interesting to share more about our method for selling a distressed company.

Source: Monthly Barometer of Collective Proceedings in France – June 202

In recent years, we have assisted underperforming companies, whether they are technology firms or service providers. From these recent sale operations, we have drawn several lessons. Here is the methodology to follow to successfully sell a company in distress or underperforming.

The 9 Key Steps:

1. Identify the performing segments in your company (“see the glass half full!”)

The first step is to thoroughly examine the company’s revenue structure. It is crucial to conduct a detailed analysis to identify the segments of offers or customers showing growth and significant market depth.

These high-growth segments are essential to attract potential buyers (we call them “Active” segments). We will consider declining segments as historical legacy not to be developed (we call them “Legacy” segments).

2. Demonstrate that these Active Segments have a deep market and customers (“we’re not alone in performing!”)

Once these segments are identified, it is imperative to provide proof of our performance. Present the targeted market configuration clearly and structurally.

Illustrate this presentation with concrete examples of recent client gains and the strategies employed to acquire them, as well as to achieve revenue gains (show the LTV of clients belonging to the “Active” segments). Customer testimonials can also enhance the credibility of these segments.

3. Correct the Cost Structure and Establish a Growth Platform (“we’re ready to bounce back!”)

Analyzing the cost structure is a crucial step. Identify costs to optimize and assess the potential impact of these adjustments on the income statement.

Present a healthy and sustainable growth plan, highlighting concrete measures taken to reduce inefficient expenses and reallocate resources to value-generating activities. Avoid being overly optimistic about short-term profit generation; such assumptions will be hard to believe.

4. Boost Your Client Acquisition During the Process (“we stay active, and it brings good results!”)

Stay attentive to client gains in Active segments to demonstrate the vitality and growth potential of your company. To do this, establish a clear commercial action plan.

Simultaneously, highlight recent good news and successes of your company, including new contract signings, strategic partnerships, or successful product launches.

5. Select the Appropriate Buyers (“we identify the most relevant and focused buyers!”)

Selecting potential buyers is of utmost importance. It is essential to target buyers capable of responding promptly and possessing expertise in company acquisitions, especially those backed by investment funds or experienced in making acquisitions.

Effective negotiation focuses not only on the price but also on the duration of negotiations and the guarantees offered. These last two aspects are particularly crucial in distressed M&A transactions.

6. Discuss Immediate Synergies (“we talk only about concrete and immediate benefits with buyers!”)

Finding simple synergies with the buyer is essential to maximize the attractiveness of the opportunity. By positioning yourself as an accessible opportunity, you can highlight geographical and offer synergies.

For example, if your company is established in a region where the buyer does not yet have a significant presence, it can open up new market and growth prospects (geographical synergy).

Similarly, if the buyer has a similar customer base, adding your products or services can enrich their portfolio, thereby increasing customer satisfaction and loyalty (same-client synergy).

7. Negotiate with Selective Transparency (“we are clear and not shooting ourselves in the foot!”)

Adopt a selective transparency approach during negotiations. It is important to be honest about the company’s history but focus on the performing aspects and ongoing improvement initiatives.

Minimize the presentation of declining segments.

8. Do Not Transfer Undesirable Liabilities (“we play fair, not passing the bad grain to our new partner!”)

It is essential to ensure not to transfer too historical liabilities to the buyer. Buyers cannot always manage liabilities that you have not been able to overcome yourself.

Plan to sell the business assets, for example, which will serve to finance the bad liabilities.

9. Establish Your Transaction Budget and Prepare Your Effort (“we stay aware that it’s going to be challenging!”)

When preparing for a distressed M&A transaction, it is essential to establish a detailed budget for the transaction and prepare a substantial financial effort.

Start by clearly defining the costs associated with each stage of the transaction, including legal fees, financial advisor fees, due diligence costs, and potential post-acquisition restructuring expenses.

Do not overlook the hidden costs of this operation, as you will need to restructure the organization, negotiate terms with banks, and respond to buyers’ questions.

In a nutshell:

Our teams often deploy this methodology for clients with distressed units.

For further details, please feel free to contact loic.gach@outmatch.fr

Last articles:

How to comunicate about the Olympics without ambush.

Disputes

Lessons from the Prime Hydration vs. United States Olympic & Paralympic Committee Case.

Distressed M&A: How to Separate the Wheat from the Chaff.

M&A

The Basics of Distressed M&A: How to Sell Effectively in Difficult Situations.

What should I do with my company's cash reserves when selling it?

M&A

The proper use of cash reserves in a sale transaction.